Understanding Identity Fraud

A Comprehensive Exploration of Identity Fraud, Its Types, and Prevention Measures

Highlights

- Definition and Distinction: Identity fraud involves the unauthorized use of personal data for fraudulent transactions, while identity theft refers to the act of stealing this data.

- Types and Methods: Various forms exist such as financial, synthetic, and criminal identity fraud, with common methods including phishing, data breaches, and tampering with biometric data.

- Prevention and Recovery: Effective strategies include strong security practices, continuous monitoring of financial statements, and immediate reporting of suspicious activities.

Introduction

Identity fraud is a pervasive and often evolving form of criminal activity where an individual uses another person's personal information without authorization. This unauthorized use aims to commit fraudulent activities or deception, frequently for financial gain. With rapid technological advances and increased reliance on digital platforms, the methods employed by fraudsters have expanded to include not only traditional tactics like physical document theft but also modern techniques such as phishing, data breaches, and synthetic identity creation.

Defining Identity Fraud

At its core, identity fraud involves the misuse of someone’s personal information—such as names, addresses, Social Security numbers, credit card details, and biometric data—to deceive or defraud either the victim or unsuspecting third parties. Although often confused with identity theft, which focuses on the illegal acquisition of personal data, identity fraud specifically refers to the application of this stolen data for illicit purposes. Understanding this distinction is essential: the theft constitutes the method of obtaining data, while the fraud encompasses the malicious use of that data.

Types of Identity Fraud

Financial Identity Fraud

Overview

Financial identity fraud is among the most commonly encountered types. It involves using stolen personal data to gain unauthorized access to credit cards, bank accounts, or loans, often resulting in significant monetary losses. Fraudsters might use the compromised information to open new accounts, apply for credit, or even make fraudulent purchases under the victim’s name. This form of identity fraud can quickly damage a person’s credit rating and lead to long-lasting financial difficulties.

Synthetic Identity Fraud

Overview

In synthetic identity fraud, fraudsters mix real data with fabricated details to create entirely new identities. For instance, they might combine a valid Social Security number (often belonging to a real person) with a counterfeit name, address, or date of birth. This new hybrid identity is then used to apply for credit cards, loans, or other financial products, which can be extremely challenging for authorities to detect because the information appears legitimate.

Criminal Identity Fraud

Overview

Criminal identity fraud occurs when a perpetrator assumes another person’s identity during interactions with law enforcement. This can include situations where an individual uses somebody else’s personal details when arrested, thereby avoiding legal consequences or complicating investigations. In such cases, the real victim may face serious repercussions, including wrongful criminal records or difficulty clearing their name, complicating the legal process significantly.

Child and Teen Identity Fraud

Overview

Younger populations are also vulnerable to identity fraud. Children and teenagers often do not monitor their financial records or credit scores, making them ideal targets. Once a child's identity is compromised, it can lie dormant for years until the fraud is discovered, leading to unforeseen financial issues when the victim eventually attempts to access credit or secure loans.

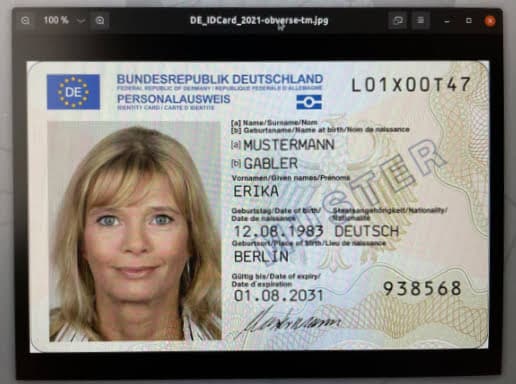

Biometric Identity Fraud

Overview

In an era where biometric data is increasingly used for secure authentication, fraudsters have also begun to explore the realm of biometric identity fraud. This form involves manipulating biometric markers like fingerprints, facial recognition data, or iris scans in order to bypass advanced security systems. While still less common, its implications are significant as it challenges the integrity and trustworthiness of biometric verification methods.

Mechanisms and Methods of Fraud

Common Techniques

Identity fraud is a multifaceted crime advanced by continually evolving techniques. Here are several prevalent methods:

Phishing and Social Engineering

Fraudsters often use deceptive emails, text messages, and phone calls that mimic legitimate institutions. Through the guise of urgency or routine verification, these schemes coax victims into providing personal details, such as passwords or account numbers. Social engineering relies on exploiting human trust rather than technical system vulnerabilities.

Data Breaches

Large-scale cyberattacks on organizations and service providers have become a common source of personal data leaks. Hackers infiltrate these systems, stealing vast amounts of sensitive data that is then sold on the dark web or used directly for fraudulent activities.

Skimming and Physical Theft

Devices installed on ATMs, fuel pumps, or point-of-sale terminals can "skim" credit and debit card data. Moreover, opportunists often resort to physical theft of documents, such as mail theft or dumpster diving, targeting personal statements or bills that contain sensitive information.

Online Scams

Identity fraud can also result from scams on social media and counterfeit websites. These scams may lure individuals into providing not only personal data but also access credentials for online accounts, making it easier for fraudsters to impersonate the victim in digital transactions.

Consequences and Impact

Financial and Legal Ramifications

The impact of identity fraud is profound and multi-dimensional. Financial losses are the most direct consequence, often occurring when fraudsters make unauthorized purchases or open new lines of credit using stolen identities. Victims may face steep fees, elevated interest rates, and long-term damage to their credit scores. In many cases, resolving these issues involves substantial time, effort, and sometimes legal intervention.

Emotional and Psychological Stress

Affected individuals typically experience significant emotional distress. The breach of privacy and the ensuing stress of constantly monitoring financial statements can lead to anxiety, depression, and a diminished sense of personal security. Victims often report feelings of violation and mistrust, which can have enduring repercussions on their mental well-being.

Operational and Reputational Damage to Organizations

Beyond individual victims, businesses and financial institutions also suffer when their clients’ data is compromised. The reputational damage and operational disruptions can lead to decreased consumer confidence, increased costs for securing systems, and potentially severe legal liabilities. Companies must invest in robust cybersecurity measures and employee training to prevent such breaches and mitigate their impacts.

Detection and Preventative Measures

For Individuals

Monitoring and Alerts

One of the most effective defenses against identity fraud is vigilant monitoring of financial accounts and credit reports. Regularly checking these statements can reveal unauthorized transactions, forgotten accounts, or discrepancies in personal data. Many banks and credit agencies offer alert systems that notify customers of irregular activities, providing an early warning mechanism.

Security Practices and Smart Habits

Individuals should adopt proactive security measures such as using strong, unique passwords for online accounts and enabling two-factor authentication (2FA) wherever possible. Shredding physical documents containing sensitive information, using secure Wi-Fi networks, and being cautious when sharing personal details online are all critical practices that reduce the risk of identity fraud.

Fraud Protection Services

Various fraud protection and identity theft monitoring services offer additional layers of security and can alert families to unusual activity. These services typically monitor credit report changes, track banking transactions, and even offer recovery assistance in the event of identity fraud.

For Organizations

Robust Verification Systems

Organizations must implement comprehensive identity verification systems to minimize fraud risks. This may include multi-factor authentication processes, biometric verification techniques, and advanced software for detecting irregular transaction patterns. Regular audits and updates to these systems play a critical role in maintaining security.

Employee Training and Awareness

Employees represent a critical line of defense. Training programs focused on recognizing phishing attempts, social engineering, and other common fraud indicators are paramount. Companies should provide updated resources to help employees spot potential fraud and encourage immediate reporting of any suspicious activities.

Data Security Infrastructure

Companies need to invest in a strong cybersecurity infrastructure, including encryption of sensitive data, secure storage practices, regular penetration testing, and monitoring for vulnerabilities. In addition, news of a data breach should prompt an immediate response plan to mitigate the consequences and notify affected parties promptly.

Practical Steps to Take if You Are a Victim

Immediate Actions

If you suspect that your identity has been fraudulently used, several immediate actions can help contain the damage:

- Contact Financial Institutions: Immediately notify your bank, credit card companies, and other financial institutions to report the suspicious activity and request new account numbers or canceled cards.

- Place a Fraud Alert or Credit Freeze: Contact major credit bureaus to place fraud alerts on your account. A more stringent measure is a credit freeze, which prevents new credit accounts from being opened in your name.

- File a Police Report: Reporting to your local police department establishes an official record of the incident, which can be critical for eventual recovery and legal proceedings.

- Report to Regulatory Authorities: In many regions, there are dedicated governmental agencies that handle identity fraud cases. In the United States, for example, the Federal Trade Commission (FTC) maintains an online portal for identity theft complaints.

- Update Passwords and PINs: Immediately change all passwords and personal identification numbers (PINs) associated with financial accounts and sensitive online services.

- Monitor Your Accounts: Continue to monitor all accounts closely. Report any further discrepancies immediately to prevent additional fraud.

Long-Term Recovery

Recovery from identity fraud can be complex and time-consuming. Victims might need to work with credit counselors and, in some cases, legal professionals to fully restore their financial standing. Persistence and thorough documentation of all interactions and steps taken are vital to monitor the restoration process over time.

Identity Fraud: A Global Challenge

While the mechanisms and impacts of identity fraud present a challenge universally, regional laws and regulatory frameworks can vary significantly. In many countries, legislation regularly updates to combat fraud more effectively, and international organizations are pushing for greater cooperation to deal with criminals who operate across borders. The collaboration between governmental institutions, private companies, and cybersecurity experts is increasingly crucial in the fight against identity fraud.

Overview Table: Key Aspects of Identity Fraud

| Aspect | Description |

|---|---|

| Definition | Unauthorized use of personal information for fraudulent purposes. |

| Common Types | Financial, synthetic, criminal, child/teen, and biometric identity fraud. |

| Primary Methods | Phishing, data breaches, skimming, social engineering, and document theft. |

| Immediate Steps for Victims | Contact financial entities, place fraud alerts, file police reports, and update passwords. |

| Preventative Measures | Monitor accounts, utilize strong security practices, implement multi-factor authentication, and employee training. |

Conclusion

Identity fraud is a multifaceted crime that not only threatens individual financial security but also poses significant challenges for businesses and institutions worldwide. Understanding the various forms—from financial and synthetic to criminal and biometric—is essential in devising effective countermeasures. While the technological sophistication behind identity fraud continues to evolve, there is an equally robust set of practices and safeguard strategies available for both individuals and organizations to mitigate risks.

The importance of vigilant monitoring, immediate action at the first sign of fraud, and proactive steps to bolster data security cannot be overstated. Whether through personal diligence such as changing credentials and freezing credit accounts or through institutional measures like implementing rigorous verification protocols and providing ongoing cybersecurity training, every stakeholder must remain alert. Moreover, the broader legal and regulatory frameworks play a crucial role in deterring fraud and providing redress for victims. Constant collaboration between public and private sectors is vital to keep pace with the evolving tactics of fraudsters and to secure financial systems.

References

- Identity Fraud - Cambridge Dictionary

- What Is Identity Fraud? Definition, Types, and Examples - IDCentral Blog

- Identity Theft - Wikipedia

-

Criminal Division | Identity Theft - United States Department of Justice

- Identity Fraud - Definition, FAQs - Innovatrics

Recommended Further Reading

Last updated February 25, 2025