Unlock the Credit Bureau's Secrets: What is a Procedural Request Letter?

Demystifying a powerful tool in your credit dispute arsenal provided by the FCRA.

When you're fighting inaccuracies on your credit report, understanding the tools available to you is crucial. One such tool, often used after an initial dispute seems to hit a dead end, is the procedural request letter. This formal communication can be pivotal in uncovering how a credit bureau verified information you believe to be incorrect.

Essential Insights into Procedural Requests

- Your Right Under Law: The Fair Credit Reporting Act (FCRA) grants you the right to ask credit bureaus for details on how they verified disputed information.

- Post-Dispute Strategy: This letter is typically sent after you've disputed an item and the bureau states it has verified the information as accurate, but you remain unconvinced.

- Mandatory Response: Credit bureaus are legally obligated to respond to your procedural request, usually within 15 days, providing specific details about their verification process.

Defining the Procedural Request Letter

Going Beyond the Initial Dispute

A procedural request letter is a formal written communication sent by a consumer to a credit reporting agency (like Experian, Equifax, or TransUnion). Its specific purpose is to ask for detailed information about the procedure the bureau used to verify an item on your credit report that you previously disputed.

Imagine you disputed a late payment listed on your report, arguing it was never late. The credit bureau investigates and responds, stating they verified the information with the creditor and it stands. If you suspect the verification was inadequate or simply want to understand how they reached that conclusion, you can send a procedural request letter. This letter essentially asks: "Show me how you checked this."

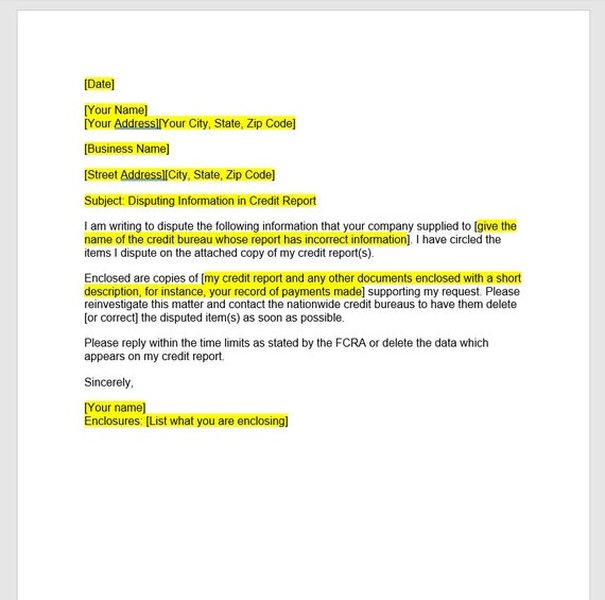

Example of a credit dispute letter format, similar in structure to a procedural request.

Why is This Letter Important?

Transparency and Accountability

The primary goal is transparency. It forces the credit bureau to be accountable for their investigation process. Under the Fair Credit Reporting Act (FCRA), credit bureaus have a legal obligation to conduct a reasonable investigation when a consumer disputes information. A procedural request demands they provide specifics about that investigation.

Gathering Evidence

The information received in response can be crucial. It might reveal flaws in the bureau's process (e.g., they only checked an electronic database without contacting the original creditor adequately) or provide you with the contact details of the entity that supposedly verified the debt. This information empowers you to take further steps, such as contacting the furnisher directly or filing complaints with regulatory bodies like the Consumer Financial Protection Bureau (CFPB).

Leverage in Disputes

Sometimes, the mere act of requesting procedural details can prompt the bureau to re-evaluate the dispute. If they cannot adequately document their verification process or realize it was flawed, they may decide to delete the disputed item rather than provide an insufficient response.

The Legal Foundation: Your Rights Under the FCRA

The right to request procedural details isn't just a courtesy; it's embedded in federal law. The Fair Credit Reporting Act provides consumers with specific protections regarding the accuracy and privacy of their credit information.

Key FCRA Provisions

- Section 611(a)(6)(B)(iii): This part of the FCRA states that if you dispute the completeness or accuracy of an item and the reinvestigation does not resolve the dispute, the credit reporting agency must provide you with a description of the procedure used to determine the accuracy and completeness of the information upon your request.

- Section 611(a)(7): This section further specifies what the description of the procedure must include. It mandates that the bureau provide you with the business name, address, and (if reasonably available) the telephone number of any furnisher of information contacted in connection with the reinvestigation.

These provisions ensure that the verification process isn't a "black box" and that consumers have the right to understand how decisions affecting their creditworthiness are made.

The 15-Day Response Window

Crucially, the FCRA mandates that the credit bureau must provide this procedural description to you within 15 days of receiving your request. This relatively short timeframe ensures you receive the information promptly, allowing you to continue your credit repair efforts without undue delay.

When and How to Send a Procedural Request Letter

Timing is Key

A procedural request letter is typically sent after the following sequence of events:

- You identify an error on your credit report.

- You send an initial dispute letter to the credit bureau outlining the error and providing evidence.

- The credit bureau conducts a reinvestigation (usually within 30-45 days).

- The credit bureau responds, stating that they have verified the disputed information as accurate, but you disagree or suspect the investigation was insufficient.

At this point, the procedural request letter becomes your next strategic step.

Crafting Your Letter

While specific templates are available online, your letter should generally include:

- Your Identifying Information: Full name, current address, date of birth, and possibly the last four digits of your Social Security number. Include any reference number from the bureau's response to your initial dispute.

- Clear Statement of Purpose: State explicitly that you are requesting a description of the procedure used to verify the disputed item(s), citing your rights under FCRA Section 611(a)(6)(B) and 611(a)(7).

- Identification of the Disputed Item(s): Clearly list the account number(s) and the specific information you disputed previously.

- Reference to Previous Communication: Mention your initial dispute and the date of the bureau's response verifying the item.

- Specific Request for Furnisher Information: Explicitly ask for the name, address, and telephone number of the furnisher contacted during the reinvestigation.

- Professional Tone: Keep the letter polite but firm.

- Supporting Documents (Optional but Recommended): You might include copies (never originals) of your initial dispute letter and the bureau's response.

Sending the Letter

Always send your procedural request letter via certified mail with a return receipt requested. This creates a documented trail, proving when the bureau received your letter, which is crucial for enforcing the 15-day response deadline.

Visualizing the Dispute Escalation Path

Dealing with credit report errors can involve several steps, each with varying levels of perceived effectiveness and effort. A procedural request fits into this broader strategy. The radar chart below provides a conceptual comparison of different dispute methods based on factors like potential impact, required effort, cost, speed, and complexity.

Note: This chart represents a conceptual comparison and relative effectiveness can vary greatly depending on individual circumstances and the specifics of the dispute. Scale is 1 (Low) to 10 (High).

Mapping the Procedural Request Process

Understanding the flow of actions involved in using a procedural request letter can clarify its role. The mindmap below illustrates the typical sequence, from identifying an issue to potential outcomes after sending the letter.

(Name, Address, Phone)"] id3b1b["Send Letter (Certified Mail)"] id3b1c["Bureau Receives Letter"] id3b1c1["Bureau Has 15 Days to Respond"] id3b1c1a["Bureau Provides Procedural Description"] id3b1c1a1["Review Bureau's Response"] id3b1c1a2["Information is Sufficient/Reveals Flaw"] id3b1c1a2a["Contact Furnisher Directly"] id3b1c1a2b["File Follow-Up Dispute"] id3b1c1a2c["File CFPB Complaint"] id3b1c1a3["Information is Insufficient/Vague"] id3b1c1a3a["Consider Further Action (CFPB, Legal)"] id3b1c1b["Bureau Fails to Respond / Responds Late"] id3b1c1b1["Potential FCRA Violation"] id3b1c1b2["File CFPB Complaint"] id3b1c1b3["Consult Attorney"]

This mindmap outlines the common path involving a procedural request, highlighting its position as a follow-up step after an initial, unsatisfactory dispute resolution.

Understanding Credit Dispute Communications

Navigating credit disputes often involves specific types of communication. The table below summarizes the key features of a Procedural Request Letter compared to an initial dispute.

| Feature | Initial Dispute Letter | Procedural Request Letter |

|---|---|---|

| Primary Purpose | To notify the credit bureau of an inaccuracy or incomplete item on the credit report and request an investigation. | To request details about how the credit bureau verified a disputed item after they claimed it was accurate. |

| Legal Basis (FCRA) | Section 611(a)(1) - Obligation to reinvestigate disputed information. | Section 611(a)(6)(B)(iii) & 611(a)(7) - Right to request description of procedure and furnisher details. |

| Timing | Sent upon discovering an error on the credit report. | Sent after receiving the bureau's response verifying a previously disputed item. |

| Bureau's Response Time | Generally 30 days (can extend to 45 days in some cases). | 15 days after receiving the request. |

| Information Requested | Correction or deletion of the inaccurate item. | Description of the verification procedure; Name, address, and phone number of the information furnisher contacted. |

| Typical Outcome Sought | Removal or correction of the error. | Transparency into the verification process, potentially leading to item removal or further action against the furnisher. |

Guidance on Dispute Letters

Understanding how to structure and write effective dispute letters is fundamental to the credit repair process. While a procedural request is a specific type of follow-up, the principles of clear, documented communication apply broadly. The video below offers insights into writing effective dispute letters, which can be adapted for procedural requests.

This video provides tips on crafting effective credit repair dispute letters, emphasizing strategies to counter credit bureau tactics.

Key takeaways often include the importance of being specific, providing evidence, maintaining records, and using certified mail. These practices are essential for both initial disputes and subsequent procedural requests to ensure your communications are taken seriously and you have proof of your correspondence.

Frequently Asked Questions (FAQ)

▶ Is a procedural request letter the same as a debt validation letter?

▶ What if the credit bureau doesn't respond within 15 days?

▶ What kind of "procedure description" should I expect?

▶ Can sending a procedural request letter guarantee removal of the item?

▶ Do I need a lawyer to send a procedural request letter?

Recommended Further Exploration

- Discover your comprehensive rights under the Fair Credit Reporting Act (FCRA).

- Learn the steps for filing a complaint with the Consumer Financial Protection Bureau (CFPB) against a credit bureau.

- Understand the distinct roles of credit bureaus versus data furnishers in the credit reporting system.

- Find sample templates for crafting effective credit dispute and procedural request letters.

References

Last updated May 5, 2025